THE ESTABLISHMENT OF THE PARLIAMENTARY BUDGET OFFICE

The Money Bills Amendment Procedure and Related Matters Act No.9 of 2009 provides for the establishment of the Parliamentary Budget Office. Section 15(1) of the Act reads as follows: "There is hereby established a Parliamentary Budget Office headed by a Director, the main objective of which is to provide independent, objective and professional advice and analysis to Parliament on matters related to the budget and other money Bills."

FUNCTIONS OF THE PARLIAMENTARY BUDGET OFFICE

The core function of the Parliamentary Budget Office is to support the implementation of the Money Bills Act by undertaking research and analysis for the four committees on Finance and Appropriations in the National Assembly and National Council of Provinces, including:

- Annually providing reviews and analysis of the documentation tabled in Parliament by the Executive in terms of this Act;

- Providing advice and analysis on proposed amendments to the fiscal framework, the Division of Revenue Bill and money Bills, and on policy proposals with budgetary implications;

- Monitoring and synthesising matters and reports tabled and adopted in a House with budgetary implications, with particular emphasis on reports by other committees;

- Keeping abreast of policy debates and developments in key expenditure and revenue areas;

- Monitoring and reporting on potential unfunded mandates arising out of legislative, policy or budgetary proposals; and

- Undertaking any other work deemed necessary by the Director to support the implementation of this Act.

Contact Details:

Parliamentary Budget Office

4th Floor

Parliament Towers

103 - 107 Plein Street

Cape Town

8001

Tel: +27 21 403 2360

Fax: +27 21 403 3153

Fax to Mail: +27 86 718 2531

Email: pboinfo@parliament.gov.za

Related Links:

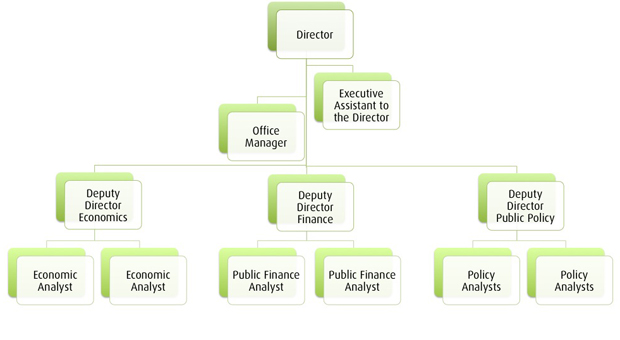

PBO AT A GLANCE

| Position | Title | Name | Telephone | |

|---|---|---|---|---|

| Director | Director: Parliamentary Budget Office | Dr Dumisani Jantjies | ||

| Executive Assistant | Executive Assistant to the Director | Ms Linda Gxabela | (021) 403 2360 | pboinfo@parliament.gov.za |

| Office Manager | Office Manager | Mr Alfred Monnakgotla | ||

| Deputy Director | Deputy Director: Economics | Dr Seeraj Mohamed | ||

| Deputy Director | Deputy Director: Finance | Vacant | ||

| Deputy Director | Deputy Director: Public Policy | Dr Nelia Orlandi | ||

| PBO Staff | Economic Analyst | Ms Kagiso Mamabolo | ||

| PBO Staff | Economic Analyst | Mr Tshepo Moloi | ||

| PBO Staff | Public Finance Analyst | Ms Sibusisiwe Sibeko | ||

| PBO Staff | Public Finance Analyst | Dr Mukundi Maphangwa | ||

| PBO Staff | Policy Analyst | Dr Mmapula Sekatane | ||

| PBO Staff | Policy Analyst | Vacant |

ORGANOGRAM

Publications

Upon request from Parliamentary committees, the PBO provides analysis and advice ahead of and following the annual tabling of the Budget Review and Medium-Term Budget Policy Statement.

PBO 2024 DORA Analysis 27 March 2024 updatedPBO 2024 Budget analysis 27 Feb 2024 Final

PBO 2024 DORA Analysis 5 March 2024

2024 Pre-budget brief Service delivery situational analysis PBO

Fiscal Brief Feb 2024

Pre-budget 2024 skills development and training brief

Pre-budget brief Global and South African economic outlook for 2024 PBO

Pre-budget brief on SA Debt and the Fiscal framework 2024

Pre-budget NSFAS brief

Local Government Underspending Metros Brief Feb 2024

DORAB Adjusted Appropriations and Eskom debt relief amendment bill 14 Nov 2023

Summary of PBO presentation 2023 MTBPS 11 Nov 2023

Q and A 07 Nov 2023 Revised Fiscal Framework

2023 MTBPS Brief 07 November 2023

Pre-MTBPS Briefs Oct 2023

Fiscal brief October 2023

Analysis of Government Underspending – Higher Education and Training 22 May 2023

Analysis of Government Underspending – Basic Education 22 May 2023

Appropriations Bill and Eskom Debt Relief – 17 May 2023

April 2023 PBO Budget and Division of Revenue Brief - 04 April

Appropriations Bill and Eskom debt relief - SCOA 20 April 2023

Brief on 2023 Division of Revenue Bill for Standing Committee on Appropriation - PBO Presentation 8 March 2023

March 2023 DORA and Second Adjustments Appropriations - PBO Presentation 15 March

Government underspending analysis 2011 - 2021 the case studies of the Departments of Health and Social Development

March 2023 PBO Fiscal Framework Summary

Oct 2022 Fiscal Brief

Oct 2022 Pre MTBPS Brief

Oct 2022 Pre MTBPS Presentation

2022 Appropriations Bills 4 May 2022

2022 Appropriations Bills 25 May 2022 PBO

2022 Appropriations Bill Parliamentary Budget Office Notes on Vote 26 Military Veterans

March 2022 Budget presentation

March 2022 DORA PBO Presentation

March 2022 DORA PBO Presentation March 2022

Feb 2022 Pre-Budget analysis report

Pre-MTBPS Brief

MTBPS Analysis

2021 Adjusted Budget

Comments on the 2021 Appropriation and Supplementary Appropriation Bills, 05 May 2021

Feb 2021 PBO Pre Budget presentation 23 Feb 2021

Feb 2021 Pre Budget analysis report version 3

March 2021 Briefing Note to Select CoA

March 2021 DORA PBO Presentation 09 March 2021 Standing CoA final converted

March 2021 DORA PBO Presentation SelectCoA 17 March 2021 final converted

March 2021 PBO Budget Presentation 02 March 2021 converted

Nov 2020 Adjusted Appropriations and DORB

Nov 2020 MTBPS Analysis 03 Nov 2020 Joint Committees Finance and Appropriations

Oct 2020 Pre MTBPS Updated

2016 Budget Review Analysis Report

2016 Pre-budget Report

Analysis of the 2016 Budget

Analysis of the 2015 Budget

The PBO provides quarterly analysis of economic developments for Members of Parliament following the release of quarterly economic data by Stats SA, the South African Reserve Bank and the National Treasury, and discusses implications of these developments for public finances. Publication dates are aligned to parliamentary terms.

Quarterly Economic Brief March 2024Quarterly Economic Brief December 2023

Quarterly Economic Brief - 19 September 2023

June 2023 Fiscal Brief 15 June 2023

June 2023 QEB 22 June

March 2023 PBO- Quarterly Economic Brief

December 2022 Quarterly Economic Brief

Quarterly Economic Brief

June 2022 QEB

March 2022

December 2021

September 2021

June 2021

March 2021

December 2020

September 2020

July 2020

April 2020

December 2019

November 2019

July 2019

September 2018

May 2018

February 2018

October 2017

July 2017

March 2017

December 2016

September 2016

June 2016

March 2016

December 2015

September 2015

June 2015

October 2014

The PBO provides analysis and advice to the legislature on a range of economic, policy and social issues with implications for money-bills and the overall health and sustainability of public finances in the realisation of the country’s development goals. Analysis and advice take the form of in-depth analysis, briefing notes, parliamentary committee briefings, and policy costings. These are generally upon request of a parliamentary committee(s), subject to capacity. The PBO also initiates research and analysis with direct implications for money bills.

PBO Brief on Revenue Amendment Bill Amendments SCOF 27 November 2023Government Underspending Analysis 2011-12 -2020-21 A Case Study of the Departments of Social Development and Departments of Basic Education - 06 September

Brief on the 2023 Taxation and Revenue Proposals - 19 September 2023

Government Underspending Analysis 2011-12 2020-21 Case Study of Basic Education 21 June 2023

PBO Brief on Vote 38 Tourism and SAT – 30 May 2023

Rules Subcommittee Briefing - 21 April 2023

PBO’s written answer to the question raised by the Select and Standing Committees on Finance on austerity

Thinking about Fiscal Consolidation - theory, ideology and consequences

June 2022 PBO Taxation Brief

DOR Adjusted Appropriations and Specl Apprn for SCOA 9 Nov 2022

DOR Presentation 10 Nov 2022

MTBPS Discussion 16 Nov

PBO briefing 2022 MTBPS 01 Nov

Fiscal Brief

Brief on Government support interventions

PBO Fiscal Brief 2021/22 Analysis 03 Aug

Orientation of the Secretary to Parliament 28 June 2022

PBO Briefing- Business Bounce-back Support and the Credit Loan Guarantee Schemes - SMMEs

PBO Brief on 2022 Draft Preferential Procurement Regulations

Feb 2022 PBO Fiscal Brief

Brief on Transport Conditional Grants

November Fiscal Brief

Understanding the sources of municipal revenue

Sep 2021 Brief on 2021 Budget Cuts on National Votes

Sep 2021 Second Special Appropriations Bills Briefing 3 September 2021

Sep 2021 Second Special Appropriations Bills

August 2021 Performance on August 2021 Basic Education Conditional Grants 18 Aug

June 2021 PBO presentation on the Fiscal Responsibility Bill 2020 June 01

June 2021 Economic Challenges for development and growth 08 June 2021 SelCOF PBO

Tools for effective budget and fiscal oversight: Parliament Existing Procures and Practice for Effective Financial Oversight- the Case for Budget Office”, NCOP Budget and Oversight Workshop, 05 May

Economic Reconstruction and Recovery Plan, SCAP Planning, Select Committee on Finance. 11 May

A guide to understanding major cryptocurrency issues and regulatory frameworks, Select Committee on Finance, 25 May 2021

2016 - The Costs and Outcomes of Industrial Development Initiatives 1994/95 -2014/15

2016 - Report on the Sustainability of South Africa’s Social Grants System

2016 - The costs and outcomes of industrial development initiatives 1994-95 - 2014-15

2016 - Electricity generation technology choice: Costs and considerations

2016 - Fiscal Analysis on Cost of Higher Education Funding in South Africa

2016 - The involvement of Public Accounts Committees in the Budget Process

2016 - 2016 Budget Analysis: Trade and Industry

2016 - The costs and outcomes of industrial development initiatives 1994/95 -2014/15

2016 - Fiscal Analysis of the Cost of Higher Education in South Africa- SCOA

2015 - BRICS New Development Bank

2015 - Funding of Heritage Commissions

2015 - Briefing note on withdrawal of the proposed UIF reduction for 2015/16

2015 - Report on State-owned Enterprises for the Standing Committee on Finance

2015 - Eskom Appropriation Bills

2015 - International agreement on the New Development Bank

2015 - Input on Rates and Monetary Amounts Amendment Bill (2015/16)

2015 - Summary Report on State-owned Enterprises for the Standing Committee on Finance

2015 - Presentation of the PBO Report on State-Owned Enterprises

2015 - The Public Sector Wage Bill: Implications for Public Finances and Economic Growth

2014 - The Regulation and Policies of the National Treasury and the South African Reserve Bank and Economic Growth

2014 - Briefing Note: The NCOP and advancing economic transformation

2014 - Briefing Note: Public infrastructure and the triple challenges of poverty, unemployment and inequality

2014 - Briefing note: the minimum wage debate in South Africa

2014 - Briefing Note: Value Added Tax VAT

2014 - The Impact of Investment on South Africa

2014 - An Overview of Government’s Medium Term Strategic Framework (MTSF) 2014 -2019 for the Standing Committee on Finance

2014 - The Impact of Investment

The PBO has undertaken…

Priority 2 Outcome 1 More decent jobs sustained final PBO2021-2022 Performance on Basic Education Conditional Grants - 19 September

Priority 2 Outcome 3 Industrialisation localisation and exports - 19 September

2021-2022 Performance on Transport Conditional Grants - 19 September

Priority 2 Outcome 2 Investing for accelerated inclusive growth 21 June

Policy Brief Performance on the 2019-2024 MTSF Policy Priority 3 Education Skills and Health

Policy Brief Performance on the 2019-2024 MTSF Priority 2 Economic Transformation and Job Creation

Policy Brief Performance on the 2019-2024 MTSF Priority 3 Education Skills and Health

Policy Brief Performance on the 2019-2024 MTSF Priority 4 Consolidating the Social Wage through Reliable and Quality Basic Services

Policy Brief Performance on the 2019-2024 MTSF Priority 5 Spatial Integration Human Settlements and Local Government

Policy Brief Performance on the 2019-2024 MTSF Priority 6 Social Cohesion and Safer Communities Part 1

Policy Brief Performance on the 2019-2024 MTSF Priority 6 Social Cohesion and Safer Communities Part 2

Policy Brief 2020-21 Performance on Basic Education Conditional Grants

Policy Brief Performance on Agriculture Conditional Grants 2020 21 April 2022

March 2022 Performance on Health Conditional Grants

Feb 2022 Performance on Transport Conditional Grants Presentation

August 2021 Policy Brief Performance on Basic Education Conditional Grants 18 Aug

August 2021 Policy Brief Performance on Human Settlement Conditional Grants

Social grant performance as at end March 20/21, 25 May 2021

Feb 2021 Policy Brief Performance on Health Conditional Grants

March 2021 Policy Brief 2019 20 Performance on Agriculture Conditional Grants

The National Development Plan Outcome 5: A skilled and capable workforce to support an inclusive growth path

The National Development Plan Outcome 4: Decent employment through inclusive economic growth

The National Development Plan Outcome 10: Protect and Enhance Our Environmental Assets and Natural Resources

The National Development Plan Outcome 12: An efficient, effective and development-oriented public service Alignment and Progress

Alignment and Progress Report on The National Development Plan Outcome 7: Comprehensive rural development and land reform

The National Development Plan Outcome 6: An efficient, competitive and responsive economic infrastructure network

2016 Budget Analysis: Trade and Industry

NDP alignment with the MTSF and progress 2014-15

The National Development Plan Outcome 3: All people in South Africa are and feel safe Alignment and Progress

The National Development Plan Outcome 13: An inclusive and responsive social protection system

The National Development Plan Outcome1: Quality Basic Education Alignment and Progress

The National Development Plan Outcome 2: A Long and Healthy Life for All South Africans: Alignment and Progress

The National Development Plan Outcome 8: Human Settlements Alignment and Progress

Budgetary proposals made by government in the Budget and Medium-Term Budget Policy Statement (MTBPS) are based on forecasts of economic growth and revenue collection. It is therefore critical for fiscal oversight that these forecasts are unbiased and as accurate as possible. The PBO conducts technical assessments for Parliament of the performance government’s forecasts of economic growth and revenue collection.

2018 - Assessing the Performance of National Treasury’s Tax Revenue Forecasts2018 - Technical Report Assessing the Performance of National Treasury’s Tax Revenue Forecasts

2017 - Assessing the Performance of National Treasury’s Tax Revenue Forecasts

2016 - Assessing the Performance of National Treasury’s Economic and Fiscal Forecasts

2016 - Assessing the Performance of National Treasury’s Economic and Fiscal Forecasts.

Brief- BRICS-PF - 27 September

Presentation Rules Committee UK Study Tour 16 July 2023

KZN PBO Presentation 28 June Dr Dumisani Jantjies

PBO Costing Estimate Analysis SL and IPU 29 June 2023

Eastern Cape Provincial Legislature Budget Committee Workshop 23_24 May 2023

PBO Joint Chair of Chairs Workshop 27-28 March 2023

Tongaat Hullett the PBOs written answer to the SCOA Nov 2022

PBO Briefing on Vote 1 Presidency Oversight November 2022

05-12-2022/FFC 23 Nov 2022

Uganda Study Visit

NCOP Legislative Review 25 November 2022 Dr Dumisani Jantjies Presentation

Members Training 17 August 2022

Public Participation AN PBO presentation 23 August

Eastern Cape Provincial Legislature Budget Committee Workshop

Orientation of the Secretary to Parliament 28 June 2022

Submission on the SADC Model Law of PF- 31 May 2022

Presentation on Mar 2022 QEB Speakers Forum 13 April 2022

March 2022 NCOP Strategic Plan 01 & 03 March 2022 DJ Jantjies

Mapping and the Budget Process Financial and Fiscal Commission

Sep 2021 BRRR Chairpersons PBO presentation 8th Sep 2021

Western Cape Legislature Budget Committee Workshop on Money Bills Amendment Procedure 21 July 2021

Workshop between PBO and AGSA 08 July 2021

March 2021 NCOP Strategic Planning Session PBO 02 March 2021

Nov 2020 Parliament Inclusive Growth Summit 25 November 2020 Dr DJ Jantjies

Oct 2020 Draft Public Procurement Bill

Contact Us

Parliamentary Budget Office

4th Floor

Parliament Towers

103 - 107 Plein Street

Cape Town

8001

Tel: +27 21 403 2360

Fax: +27 21 403 3153

Fax to Mail: +27 86 718 2531

Email: pboinfo@parliament.gov.za