The issue of municipal electricity debt is dire and could break the functioning of South Africa’s power utility Eskom, the Standing Committee on Public Accounts (Scopa) heard on Tuesday.

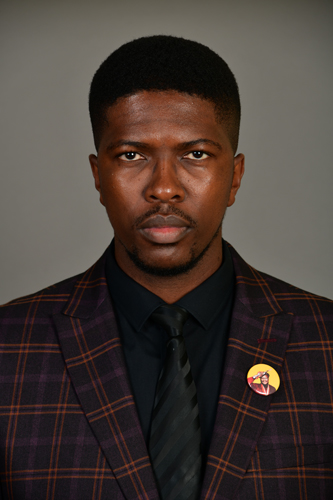

Eskom’s Acting Chief Executive Officer (CEO) Mr Phakamani Hadebe told the Committee that the debt situation was dire and had reached unsustainable levels.

“In one year the debt increased by 33%, excluding Soweto. This debt moved from R5.5 billion to R13.3 billion, this is an increase of 139% in two years. Even the areas which were paying are no longer paying they have a bench mark,” Mr Hadebe said.

“It has been challenging. At this level we have reached a stage where the rating agencies want to downgrade Eskom even further. The second issue that poses danger to Eskom is that lenders have said they will not lend further if Eskom continued in this trajectory,” he said.

Mr Hadebe formed part of a strong Eskom delegation that came to brief the Committee on municipal debt on Tuesday.

He told Scopa the interventions that had been put in place have not worked, and that this was beyond Eskom. He also indicated that Eskom is faced with a situation of having to raise about R72 billion from the market in less than four months.

He requested Scopa to help in identifying opportunities of how the R72 billion could be raised.

The Chairperson of the Committee Mr Themba Godi, said the Committee was aware that the new leadership was called upon to rescue an ailing institution that was almost on its knees.

“We have discussed these issues last year, and now we want to see if we making progress. The Committee is concerned about the issues around Eskom that are unfolding, and we have looked at it and asked to what extent does it impact on Eskom balance sheet,” he said.

Board Member, and Chair of Eskom audit and risk, Ms Sindi Mabaso-Koyana, also said in the short time that the new board has been in place it had been engaged in finding neat solutions to the liquidity issues Eskom faced.

“We need to root out malfeasance and mismanagement to restore strong governance. Stabilisation of governance of Eskom is a priority, and non-negotiable. We were appointed to take difficult decision to turn Eskom around,” Ms Mabaso-Koyana said.

She revealed that a R30 billion credit facility had been secured and that progress was being made in clearing the audit query from last year.

She assured the Committee that although Eskom has seen the departure of several executives their resignations did not mean they were excluded from civil claims against them should a need arise.

“Financial sustainability is in jeopardy if we are unable to secure our debt. We need to take bold decision and with an understanding that all the stakeholders are required to do the right thing,” Ms Mabaso-Koyana said.

Sibongile Maputi